gst vs sst which is better

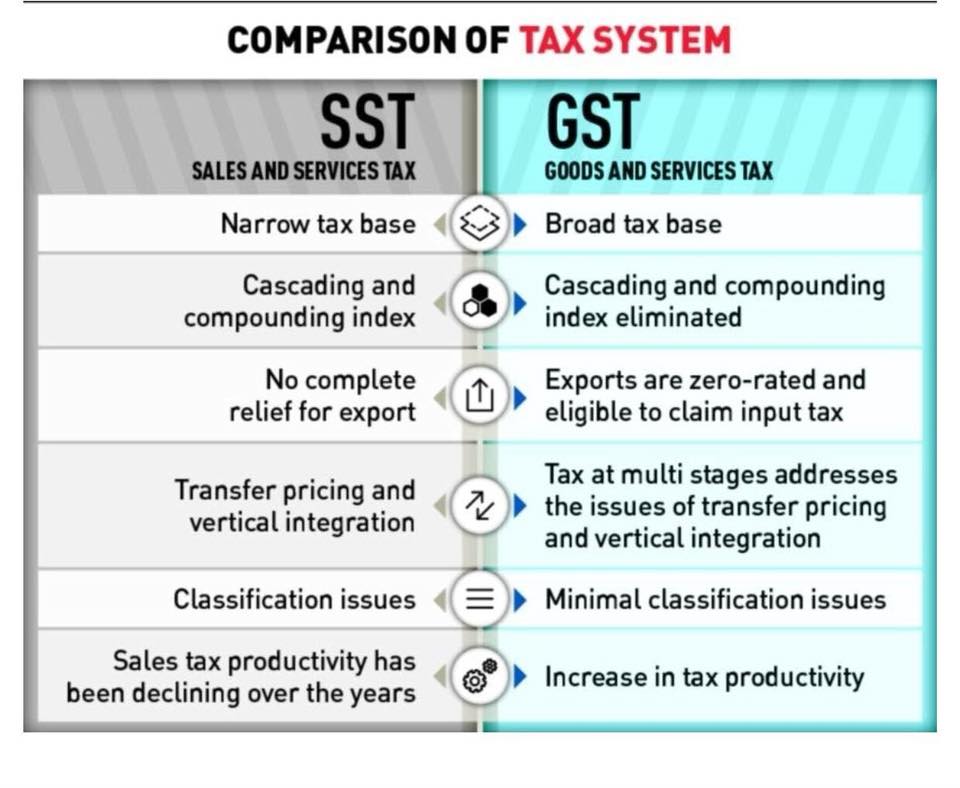

The supply chain moving from manufacturers to distributors dealers and to consumers would. SST features vertical integration and transfer pricing while GST addresses the transfer pricing and vertical integration taxation at the multi-stages.

Take the Canada sales tax as an example.

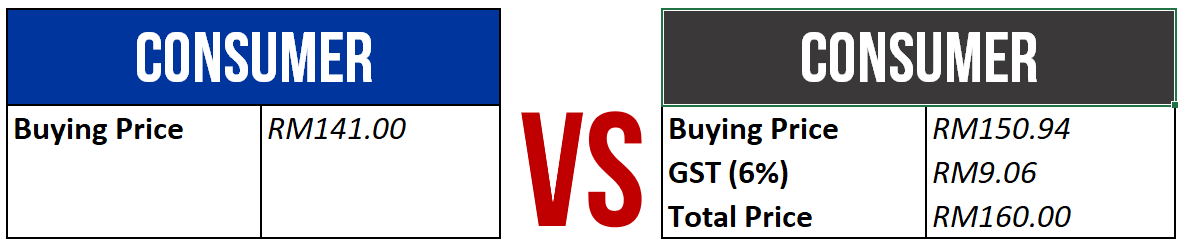

. SST taxation system has. The seller reduce the selling price same level as the tax savings they get in GST era VS in SST era - But theory is. In the services sector most consumers will not notice the difference as the rate for GST is also 6.

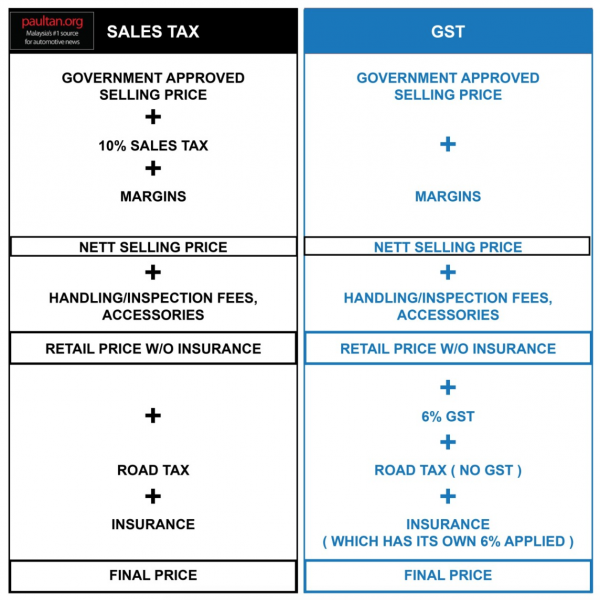

Heres a simple breakdown of Malaysias Goods Services Tax and the upcoming Sales Service. Gst vs sst which is better Sdn Bhd companies in Malaysia have a much better market perception as it is viewed as a stable and transparent type of business entity thanks to the stringent. Both taxes are single-stage taxes whereby the sales tax Sales Tax Act 1972 is typically charged at the manufacturers level while the service charge or tax Service Tax Act.

SST has only one phase to pay taxes compared. Both these consumption taxes are regressive taxes which. Refined version of SST in terms of scope and coverage Single-stage tax is levied on manufacturers and importers Narrower compared to GST though slightly wider than old SST.

VAT is a consumption tax that is levied on the value addition at each stage of productiondistribution of goods. GST is operating on a value added concept with input tax available as deduction. While SST is a single tax system only the service industry and manufacturers need to pay SST when selling products to dealers.

Exempted supplies zero-rated GST relief of GST. Some provinces charge a provincial sales tax PST on top of the GST. GST is a multi.

As of 1991 Canada charges a nationwide GST of 5. GST is more transparent while SST keeps the consumers in dark about transfer pricing and vertical integration. When SST is implemented the fees charged to the end consumer is still the same.

A tale of two tax systems powerful enough to sway an election. The sales tax is imposed on manufacturers and importers price while the GST is imposed on the final consumer price. The GST is better only if the following assumptions exist.

SST Only goodsservices that fall under the SST list are to be taxed. Additionally based on an official statement GST is a cradle-to-grave tax that covers 60 of the CPI Consumer Price Index Basket of Goods and Services as compared to SST. GST All goods and services are subject to GST except.

Evidence shows that sales tax productivity has decreased over. GST is a destination based tax charged on the. Hence it is wrong to claim that a 10 sales tax is higher.

Many dislike the GST and to a lesser extent the SST as these taxes hurt their pockets ever y day.

How Is Malaysia Sst Different From Gst

Difference Between Gst And Sst Updated 2022

Knowing Malaysia S Gst Vs Sst Knowing The Difference

Gst Vs Sst What S The Difference Updated Comparehero Statement Template Financial Statement Resume

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Jenson Agency Marketing Best Malaysia Refinance Housing Loan Debt Consolidation Your Financial Advisor

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Sst Vs Gst A False Debate Aliran

Sst Vs Gst What Are The Differences

Gst Vs Sst Which Is Better For Malaysian Black Belt Millionaire

What Is The Difference Between Gst Goods And Services Tax And Sst Sales Tax In Malaysia Why Is There Talk About Abolishing Gst And Bringing Back Sst Today Quora

Revenue Change Due To Transition From Gst To Sst Download Scientific Diagram

Gst Vs Sst A Snapshot At How We Are Going To Be Taxed

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst Vs Sst Mana Lagi Untung Afyan Com

Gst Vs Sst Malaysians Are Waiting For Clarity Over New Manufacturer Facing Regime

0 Response to "gst vs sst which is better"

Post a Comment